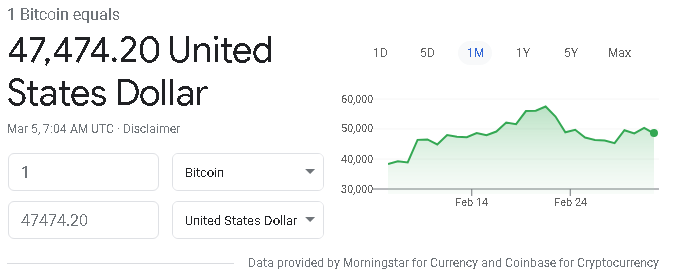

Bitcoin has recently been a big talk in finance news and every social media platform. Personally I don’t hold any Bitcoin and at this price point I probably never will. But this led me to wonder whether or not there are other cryptocurrency that I can still mine. I don’t have a custom build cryptocurrency mining computer. I only have a simple laptop and a smartphone.

Doing research led me to multiple apps with the ability to mine their “coins”. The most popular one is Pi Network. It was founded in 2019 by Stanford graduates Nicolas Kokkalis Ph.D., Chengdiao Fan Ph.D., and Vince McPhilip M.B.A. The goal of the project was to make crypto accessible to everyone. (source)

The issue with Bitcoin is that most of them are owned and mined by big corporations. Because of this, a very small percentage of individuals in the general population hold Bitcoin. It’s not easily accessible to most people. The Pi Network aims to address that issue and make their crypto available to everyone with a smartphone. You can check out their website and Q&A page here. It’s a great idea and a lot of people got onboard. As of December 2020, Pi Network has more than 10 million users mining Pi Coins from the app. (source)

I just started yesterday and invite 7 friends. So far I have 15 Pi Coins. As of right now the coins are worth nothing. However, they plan to start mainnet for Pi Network in Phase 3 (estimated to be around late 2021 and early 2022). The project timeline is on their Reddit page here. However, as I researched more, I also started reading articles about skepticisms of the app.

Research done by Ai Multiple is saying that Pi Network may be a scam. Can it be? From my own experience, when setting up the app it did not ask me for ID or any official documents to verify my name. All it asks me to do is to make sure that my name is the same exactly as it is shown on my official ID documents. This may imply that Pi Network will later on require official documentations in order to withdrawal funds once reaching mainnet. However, that’s not the only thing I’ve noticed. Many people online have noticed that when you set your phone clock ahead in time, your Pi Coin count increases accordingly with the time. Does this mean Pi Coin = time? I couldn’t find any specific documentation that gave a clear answer. In addition, there are other variables that led many people to having second thoughts about these kinds of apps. You can read about them here.

Overall, whether or not Pi Network is a scam, I still plan to continue to use it for the time being. Even if they reach mainnet and require official ID documentation, it will be a very long time for the Pi Coins to gain any value. Until then, I will slowly keep growing my Pi Coins.

Disclaimer: this article is only for educational purposes and not meant to be a recommendation or financial advice. If you do plan to join the Pi Network, do so at your own risk with your own research first.